I recently posted about sprawl in its purest form in Cleveland. Cuyahoga County massively expanded its urbanized footprint while the population remained the same.

A couple of recent articles from Crain’s Chicago highlight the same thing happening in that city – with the same results in terms of negative filtering of homes and stagnant to declining housing prices.

Metro Chicago has lost population for the last two years. But a better way to characterize it is stagnant. The population shrinkage is tiny. On the other hand, the growth that came before it was tiny too. Chicago metro grew from about eight million to about nine million people between 1990 and 2000. Yet here we are nearly 20 years later and there’s no sign of ten million, a level that I would assume would be hit at some point, but which is not a slam dunk.

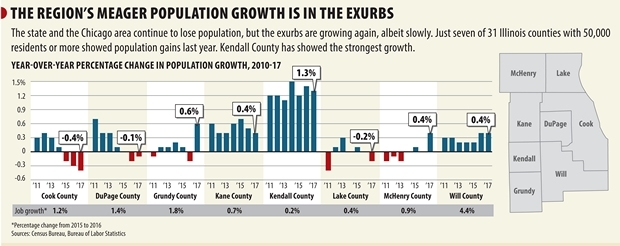

Metro Chicago growth by county. Image via Crain’s Chicago.

Yet despite this stagnation of regional population, exurban communities are starting to expand and grow again. Per Crain’s:

The Chicago area is on its third straight year of population decline, but there is one pocket of growth. The far western edge of the metro area is adding residents again, albeit slowly. You can see it in subdivisions in Kendall County, such as the Grande Reserve in Yorkville, where home construction on tracts of former farmland has restarted.

Kendall County, which was the fastest-growing county in the country before the Great Recession, still leads the way in the Chicago area. The number of residents grew 1.3 percent in 2017, according to the latest estimates from the U.S. Census Bureau.

…

“There’s a reshuffling and shifting going on,” Chicago-based demographic researcher Rob Paral says of the population trends. “Overall, there’s stagnation. You’ve got one major node that’s doing well. This is a problem. It’s not like things are going to crash. There’s just no or slow growth. There’s no reason to think it’s going to change in the near future.”

One reason that growth has ticked up there is that at least some Kendall County communities appear to be handing out housing incentives:

This is what a recovery looks like on a small scale: Yorkville, a town of about 19,000, had 212 housing starts last year, up from 151 in 2016 and 84 in 2015. At the pre-recession peak in 2006, it was about 1,000, says City Administrator Bart Olson. The city primed the reboot with an incentive program, funded by developers and the city, that gave checks of about $10,000 to buyers of new homes. Two-thirds of new residents surveyed say they moved to Yorkville because of it, Olson says. The program, used by more than 400 people in five years, ended in December. “I’m anxious to see what happens,” says Mayor Gary Golinski. “I imagine we’ll see a small decline. But I feel like things are on an upswing.”

What are the results? Another new Crain’s article reveals that Chicagoland has the lowest price appreciation of any major metro in the country last year – even lower than Cleveland and Detroit. Even super-high end suburbs like Lake Forest and Wilmette have seen actual price declines:

If homeowners want to make money on real estate, metro Chicago is not where they want to be. Since the housing market crashed in 2007, home prices here have recovered more slowly than in almost every other urban center. Last year, home values increased nationally 6.3 percent, and they shot up by double-digit rates in two big markets: Seattle (12.7 percent) and Las Vegas (11.1 percent), according to S&P CoreLogic Case-Shiller Indices. Chicago, which has languished near the bottom for years, finished dead last among the 20 largest U.S. cities in 2017, with a 2.6 percent rise. With values increasing at the slowest rate in two years, Chicago was the worst again in January.

The local market also has the nation’s largest number of underwater homes, meaning an owner owed more on the mortgage than the property was worth. At year-end, more than 135,000 Chicago-area homes were underwater, more than the total in New York and Los Angeles combined, CoreLogic reported in March.

Why is Chicago lagging so badly? Economists and others say the key problem is exceptionally slow employment growth, tangled with two issues most Illinois residents are familiar with: population losses and high taxes that are likely to go higher.

“There’s a direct correlation in the declining demand for homes,” says Michael Hicks, an economics professor at Ball State University in Muncie, Ind., who studies the Midwest economy. “It doesn’t take very much outmigration or static population growth to stall home price growth.” That’s in part because each household that moves away essentially adds two units to the Chicago area’s for-sale inventory: the house they put up for sale and the one they didn’t move into.

Hicks hits on the population part of the equation, but new housing construction in a market with a stagnant population means negative filtering of real estate prices, and ultimately abandonment of the least valuable housing. It devalues real estate generally.

The focus of the Crain’s article is on high end real estate. But the most pernicious aspects of this are for working class and minority home ownership. Black homeowners in many of the south suburbs have seen their investments essentially wiped out by price declines, even though they’ve continued to faithfully make payments. This is one factor that drives highly divergent household income levels between blacks and whites.

Again, as Paral notes, you can point to segments of the region that are hot. But these hot pockets are part of an overall metropolitan system. To the extent that there are localized booms on the North Side and Oswego, this only makes other parts of the market even less valuable than they otherwise would be. I believe this is the root of Pete Saunders critique of the Yimby movement to build even more in the hottest areas. Maybe he will chime in with a post with more thoughts.

from Aaron M. Renn

http://www.urbanophile.com/2018/04/02/sprawl-without-growth-chicago-edition/

No comments:

Post a Comment